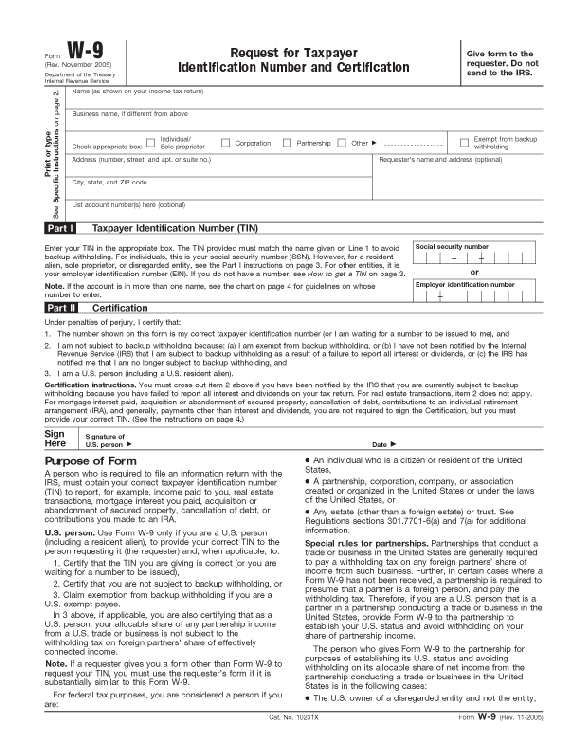

If you are a resident alien and do not have a social security number, you will enter your individual taxpayer identification number (ITIN) instead of a social security number. If you are a business, you will fill out your employer identification number (EIN) instead of your social security number. You will simply enter your name, business name (if applicable), your tax classification, full address, and social security number. How do I fill out form W-9 in 2022?įorm W 9 is very straightforward. The W-4 helps them to calculate how much to withhold. The W9 form provides the employer with all of the required identification information. What other forms accompany form W-9?įorm W-9 is usually accompanied by form W-4. In some special cases, such as if you are an independent contractor, your client may request a W-9 from you so they can accurately prepare the 1099-NEC form and report how much they paid you at the end of the year. Who needs form W-9?īusinesses with employees need the W9 form to properly file their taxes. Form W-9 provides an employer with that identification number. In order for employers to properly withhold taxes from an employee’s pay, they need the employee’s identification number. Every taxpayer has an identification number.

IRS Form W-9 (Request for Taxpayer Identification Number and Certification) is a tax form used by employers to identify their employees.

0 kommentar(er)

0 kommentar(er)